| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | | | | |

| Orion Supplemental Information | |

September 30, 2023 | |

| | | | | |

| Section | Page |

| |

| About the Data | |

| Forward-Looking Statements | |

| Company Overview | |

| Balance Sheets | |

| Statements of Operations | |

| Funds From Operations (FFO), Core FFO and Funds Available for Distribution (FAD) | |

| EBITDA, EBITDAre and Adjusted EBITDA | |

| Capital Structure | |

| Debt Detail | |

| Ratio Analysis | |

| Credit Facility Revolver Covenants | |

| Net Operating Income (NOI) and Cash NOI | |

| |

| Leasing Activity | |

| Vacant Property Operating Expenses | |

| Dispositions | |

| Diversification Statistics: Real Estate Portfolio | |

| Tenants Comprising Over 1% of Annualized Base Rent | |

| Tenant Industry Diversification | |

| Property Geographic Diversification | |

| Lease Expirations | |

| Lease Summary | |

| Full Portfolio | |

| Unconsolidated Joint Venture Investment Summary | |

| Definitions | |

Orion Office REIT Inc. | WWW.ONLREIT.COM | 2

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

This data and other information described herein are as of and for the three months ended September 30, 2023, unless otherwise indicated. Future performance may not be consistent with past performance and is subject to change and inherent risks and uncertainties. This information should be read in conjunction with the consolidated and combined financial statements and the Management's Discussion and Analysis of Financial Condition and Results of Operations sections contained in Orion Office REIT Inc.'s (the "Company," "Orion," "us," "our" and "we") Quarterly Reports on Form 10-Q for the periods ended September 30, 2023, June 30, 2023 and March 31, 2023 and Annual Report on Form 10-K for the year ended December 31, 2022.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 3

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

| Forward-Looking Statements |

|

Information set forth herein includes “forward-looking statements” which reflect the Company's expectations and projections regarding future events and plans, future financial condition, results of operations, liquidity and business, including leasing and occupancy, acquisitions, dispositions, rent receipts, expected borrowings and financing costs and the payment of future dividends. Generally, the words "anticipates," "assumes," "believes," "continues," "could," "estimates," "expects," "goals," "intends," "may," "plans," "projects," "seeks," "should," "targets," "will," "guidance," variations of such words and similar expressions identify forward-looking statements. These forward-looking statements are based on information currently available to the Company and involve a number of known and unknown assumptions and risks, uncertainties and other factors, which may be difficult to predict and beyond the Company's control, that could cause actual events and plans or could cause the Company's business, financial condition, liquidity and results of operations to differ materially from those expressed or implied in the forward-looking statements. Further, information regarding historical rent collections should not serve as an indication of future rent collections.

The following factors, among others, could cause actual results to differ materially from those set forth in the forward-looking statements:

•the risk of rising interest rates, including that our borrowing costs may increase and we may be unable to refinance our debt obligations on favorable terms and in a timely manner, or at all;

•the risk of inflation, including that our operating costs, such as insurance premiums, utilities, real estate taxes, capital expenditures and repair and maintenance costs, may rise;

•conditions associated with the global market, including an oversupply of office space, tenant credit risk and general economic conditions and geopolitical conditions;

•the extent to which changes in workplace practices and office space utilization, including remote work arrangements, will continue and the impact that may have on demand for office space at our properties;

•our ability to acquire new properties and sell non-core assets on favorable terms and in a timely manner, or at all;

•our ability to comply with the terms of our credit agreements or to meet the debt obligations on our properties, including our ability to satisfy the conditions to extend our credit facility revolver;

•our ability to access the capital markets to raise additional equity or refinance maturing debt on favorable terms and in a timely manner, or at all;

•changes in the real estate industry and in performance of the financial markets and interest rates and our ability to effectively hedge against interest rate changes;

•the risk of tenants defaulting on their lease obligations, which is heightened due to our focus on single tenant properties;

•our ability to renew leases with existing tenants or re-let vacant space to new tenants on favorable terms and in a timely manner, or at all;

•the cost of rent concessions, tenant improvement allowances and leasing commissions;

•the potential for termination of existing leases pursuant to tenant termination rights;

•the amount, growth and relative inelasticity of our expenses;

•risks associated with the ownership and development of real property;

•risks accompanying the management of OAP/VER Venture, LLC, our unconsolidated joint venture, in which we hold a non-controlling ownership interest;

•our ability to close pending real estate transactions, which may be subject to conditions that are outside of our control;

•our ability to accurately forecast the payment of future dividends on our common stock, and the amount of such dividend;

•risks associated with acquisitions, including the risk that we may not be in a position, or have the opportunity in the future, to make suitable property acquisitions on advantageous terms and/or that such acquisitions will fail to perform as expected;

•risks associated with the fact that we have a limited operating history and our future performance is difficult to predict;

•our properties may be subject to impairment charges;

•risks resulting from losses in excess of insured limits or uninsured losses;

•risks associated with the potential volatility of our common stock; and

•the risk that we may fail to maintain our qualification as a REIT.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 4

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

Additional factors that may affect future results are contained in the Company's filings with the SEC, which are available at the SEC’s website at www.sec.gov. The Company disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of changes in underlying assumptions or factors, new information, future events or otherwise, except as required by law.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 5

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Company Overview (unaudited) |

|

Orion is a real estate company incorporated in the state of Maryland on July 1, 2021, which has been operating in a manner so as to qualify and has elected to be taxed as a real estate investment trust ("REIT") for U.S. federal income tax purposes, commencing with our initial taxable year ended December 31, 2021.

Orion is an internally managed REIT engaged in the ownership, acquisition and management of a diversified portfolio of mission-critical regional and corporate headquarters office buildings in high-quality suburban markets across the U.S. and leased primarily on a single-tenant net lease basis to creditworthy tenants. As of September 30, 2023, Orion owned and operated a portfolio of 79 office properties totaling approximately 9.3 million leasable square feet located within 29 states. In addition, the Company owns a 20% equity interest in one Unconsolidated Joint Venture with an affiliate of Arch Street Capital Partners, which, as of September 30, 2023, owned a portfolio consisting of six office properties totaling approximately 1.0 million leasable square feet located within six states. As of September 30, 2023, approximately 72.0% of the Company's Annualized Base Rent was from Investment-Grade Tenants, the Company's Occupancy Rate was 80.5%, or 88.7% adjusted for properties that have been sold following quarter end or are currently under agreement to be sold, and the Weighted Average Remaining Lease Term was 3.9 years.

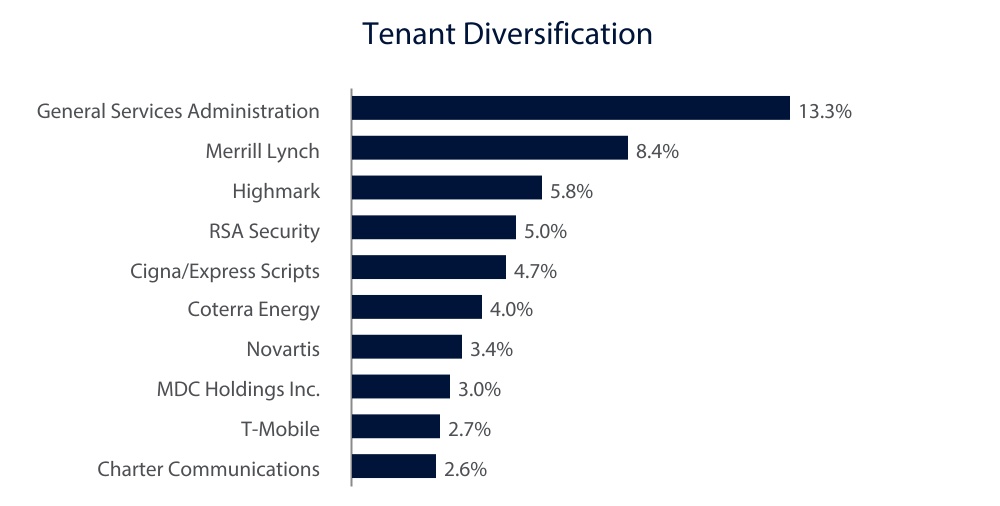

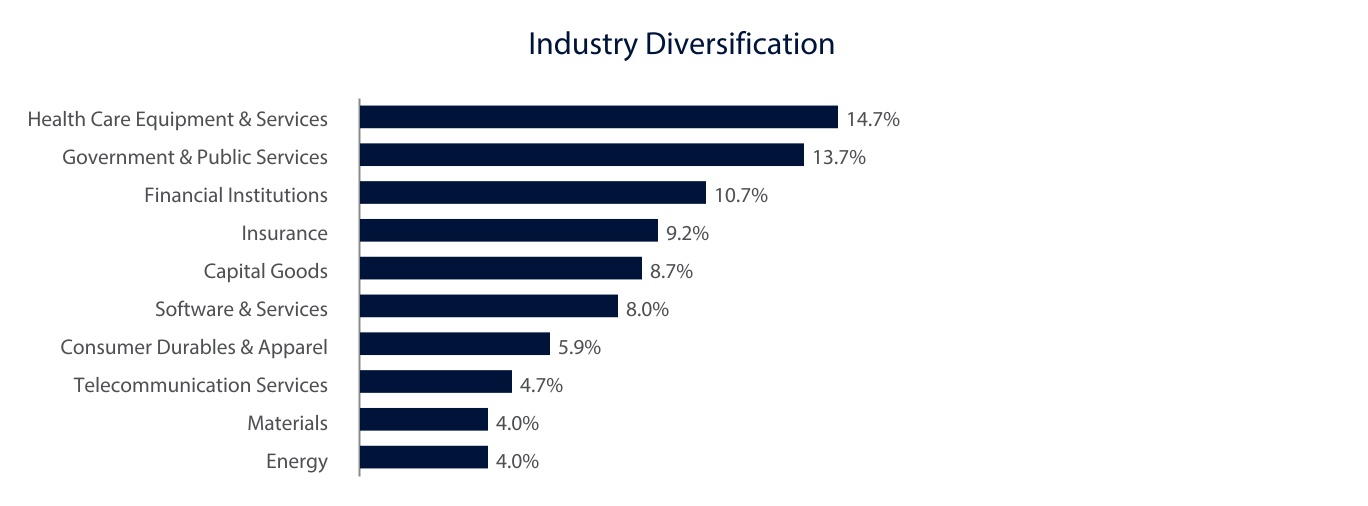

The Company's Annualized Base Rent as of September 30, 2023 was approximately $144.9 million. The top tenants, tenant industries and geographic locations of the Company's properties are outlined in the following sections: "Tenants Comprising Over 1% of Annualized Base Rent," "Tenant Industry Diversification," and "Property Geographic Diversification," respectively.

Tenants, Trademarks and Logos

Orion is not affiliated or associated with, is not endorsed by, does not endorse, and is not sponsored by or a sponsor of the tenants or of their products or services pictured or mentioned. The names, logos and all related product and service names, design marks and slogans are the trademarks or service marks of their respective companies.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 6

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | | | | | | | |

| Senior Management | | Board of Directors |

| | |

| Paul H. McDowell, Chief Executive Officer, President | | Reginald H. Gilyard, Non-Executive Chairman, Independent Director |

| | |

| Gavin B. Brandon, Executive Vice President, Chief Financial Officer and Treasurer | | Kathleen R. Allen, Ph.D., Independent Director |

| | |

| Christopher H. Day, Executive Vice President, Chief Operating Officer | | Richard J. Lieb, Independent Director |

| | |

| Gary E. Landriau, Executive Vice President, Chief Investment Officer | | Gregory J. Whyte, Independent Director |

| | |

| Paul C. Hughes, General Counsel and Secretary | | Paul H. McDowell, Chief Executive Officer, President and Director |

| | |

| Revea L. Schmidt, Senior Vice President, Chief Accounting Officer | | |

Corporate Offices and Contact Information

| | | | | | | | |

| 2398 E. Camelback Road, Suite 1060 | | 19 West 44th Street, Suite 1401 |

| Phoenix, AZ 85016 | | New York, NY 10036 |

| 602-698-1002 | | |

| www.ONLREIT.com | | |

Trading Symbol: ONL

Stock Exchange Listing: New York Stock Exchange

Transfer Agent

| | |

| Computershare Trust Company, N.A. |

| 462 South 4th Street, Suite 1600 |

| Louisville, KY 40202 |

| 855-866-0787 |

Orion Office REIT Inc. | WWW.ONLREIT.COM | 7

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Balance Sheets (unaudited, in thousands) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2022 |

| Assets | | | | | | | | | | |

| Real estate investments, at cost: | | | | | | | | | | |

| Land | | $ | 227,203 | | | $ | 229,105 | | | $ | 236,966 | | | $ | 238,225 | | | $ | 243,726 | |

| Buildings, fixtures and improvements | | 1,106,383 | | | 1,111,646 | | | 1,127,590 | | | 1,128,400 | | | 1,137,177 | |

| Total real estate investments, at cost | | 1,333,586 | | | 1,340,751 | | | 1,364,556 | | | 1,366,625 | | | 1,380,903 | |

| Less: accumulated depreciation | | 156,904 | | | 149,147 | | | 141,093 | | | 133,379 | | | 126,097 | |

| Total real estate investments, net | | 1,176,682 | | | 1,191,604 | | | 1,223,463 | | | 1,233,246 | | | 1,254,806 | |

| Accounts receivable, net | | 26,911 | | | 24,960 | | | 24,697 | | | 21,641 | | | 21,923 | |

| Intangible lease assets, net | | 144,304 | | | 161,885 | | | 182,629 | | | 202,832 | | | 223,528 | |

| Cash and cash equivalents | | 32,286 | | | 42,209 | | | 23,755 | | | 20,638 | | | 23,282 | |

| Real estate assets held for sale, net | | 3,818 | | | 16,251 | | | 2,502 | | | 2,502 | | | 6,383 | |

| Other assets, net | | 120,390 | | | 90,998 | | | 89,826 | | | 90,214 | | | 91,632 | |

| Total assets | | $ | 1,504,391 | | | $ | 1,527,907 | | | $ | 1,546,872 | | | $ | 1,571,073 | | | $ | 1,621,554 | |

| | | | | | | | | | |

| Liabilities and Equity | | | | | | | | | | |

| | | | | | | | | | |

| Mortgages payable, net | | $ | 352,683 | | | $ | 352,509 | | | $ | 352,337 | | | $ | 352,167 | | | $ | 351,994 | |

| Credit facility term loan, net | | — | | | — | | | 174,153 | | | 173,815 | | | 173,478 | |

| Credit facility revolver | | 175,000 | | | 175,000 | | | — | | | — | | | 31,000 | |

| Accounts payable and accrued expenses | | 30,570 | | | 22,326 | | | 19,957 | | | 26,161 | | | 22,038 | |

| Below-market lease liabilities, net | | 9,481 | | | 10,996 | | | 12,526 | | | 14,068 | | | 15,611 | |

| Distributions payable | | 5,578 | | | 5,670 | | | 5,666 | | | 5,664 | | | 5,664 | |

| Other liabilities, net | | 21,811 | | | 23,682 | | | 22,286 | | | 23,340 | | | 21,085 | |

| Total liabilities | | 595,123 | | | 590,183 | | | 586,925 | | | 595,215 | | | 620,870 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Common stock | | 56 | | | 57 | | | 57 | | | 57 | | | 57 | |

| Additional paid-in capital | | 1,143,825 | | | 1,148,155 | | | 1,147,466 | | | 1,147,014 | | | 1,146,431 | |

| Accumulated other comprehensive income | | 986 | | | 3,026 | | | 4,540 | | | 6,308 | | | 7,057 | |

| Accumulated deficit | | (237,026) | | | (214,929) | | | (193,516) | | | (178,910) | | | (154,273) | |

| Total stockholders' equity | | 907,841 | | | 936,309 | | | 958,547 | | | 974,469 | | | 999,272 | |

| Non-controlling interest | | 1,427 | | | 1,415 | | | 1,400 | | | 1,389 | | | 1,412 | |

| Total equity | | 909,268 | | | 937,724 | | | 959,947 | | | 975,858 | | | 1,000,684 | |

| Total liabilities and equity | | $ | 1,504,391 | | | $ | 1,527,907 | | | $ | 1,546,872 | | | $ | 1,571,073 | | | $ | 1,621,554 | |

| | | | | | | | | | |

Orion Office REIT Inc. | WWW.ONLREIT.COM | 8

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Statements of Operations (unaudited, in thousands, except per share data) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2022 |

| Revenues: | | | | | | | | | | | | |

| Rental | | | | $ | 48,876 | | | $ | 51,824 | | | $ | 49,990 | | | $ | 50,097 | | | $ | 51,580 | |

| Fee income from unconsolidated joint venture | | | | 200 | | | 200 | | | 200 | | | 197 | | | 189 | |

| Total revenues | | | | 49,076 | | | 52,024 | | | 50,190 | | | 50,294 | | | 51,769 | |

| Operating expenses: | | | | | | | | | | | | |

| Property operating | | | | 15,506 | | | 15,487 | | | 15,344 | | | 15,746 | | | 15,303 | |

| General and administrative | | | | 4,367 | | | 4,565 | | | 4,309 | | | 4,428 | | | 4,672 | |

| Depreciation and amortization | | | | 27,013 | | | 27,877 | | | 28,166 | | | 30,493 | | | 32,693 | |

| Impairments | | | | 11,403 | | | 11,819 | | | 3,754 | | | 12,198 | | | 44,801 | |

| Transaction related | | | | 101 | | | 150 | | | 105 | | | 277 | | | 194 | |

| | | | | | | | | | | | |

| Total operating expenses | | | | 58,390 | | | 59,898 | | | 51,678 | | | 63,142 | | | 97,663 | |

| Other (expenses) income: | | | | | | | | | | | | |

| Interest expense, net | | | | (7,380) | | | (7,222) | | | (7,139) | | | (7,553) | | | (7,904) | |

| Gain on disposition of real estate assets | | | | 18 | | | — | | | — | | | 1,293 | | | 1,059 | |

| Loss on extinguishment of debt, net | | | | — | | | (504) | | | — | | | — | | | — | |

| | | | | | | | | | | | |

| Other income, net | | | | 437 | | | 165 | | | 36 | | | 105 | | | 31 | |

| Equity in loss of unconsolidated joint venture, net | | | | (108) | | | (95) | | | (123) | | | (272) | | | (157) | |

| Total other (expenses) income, net | | | | (7,033) | | | (7,656) | | | (7,226) | | | (6,427) | | | (6,971) | |

| Loss before taxes | | | | (16,347) | | | (15,530) | | | (8,714) | | | (19,275) | | | (52,865) | |

| Provision for income taxes | | | | (160) | | | (185) | | | (160) | | | 282 | | | (164) | |

| Net loss | | | | (16,507) | | | (15,715) | | | (8,874) | | | (18,993) | | | (53,029) | |

| Net (income) loss attributable to non-controlling interest | | | | (12) | | | (15) | | | (11) | | | 23 | | | (18) | |

| Net loss attributable to common stockholders | | | | $ | (16,519) | | | $ | (15,730) | | | $ | (8,885) | | | $ | (18,970) | | | $ | (53,047) | |

| | | | | | | | | | | | |

| Weighted-average shares outstanding - basic and diluted | | | | 56,543 | | | 56,680 | | | 56,642 | | | 56,644 | | | 56,635 | |

| Basic and diluted net loss per share attributable to common stockholders | | | | $ | (0.29) | | | $ | (0.28) | | | $ | (0.16) | | | $ | (0.33) | | | $ | (0.94) | |

Orion Office REIT Inc. | WWW.ONLREIT.COM | 9

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Funds From Operations (FFO), Core FFO and Funds Available for Distribution (FAD) (unaudited, in thousands, except per share data) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2022 |

| Net loss attributable to common stockholders | | | | $ | (16,519) | | | $ | (15,730) | | | $ | (8,885) | | | $ | (18,970) | | | $ | (53,047) | |

| Adjustments: | | | | | | | | | | | | |

| Depreciation and amortization of real estate assets | | | | 26,988 | | | 27,852 | | | 28,142 | | | 30,475 | | | 32,674 | |

| Gain on disposition of real estate assets | | | | (18) | | | — | | | — | | | (1,293) | | | (1,059) | |

| Impairment of real estate | | | | 11,403 | | | 11,819 | | | 3,754 | | | 12,198 | | | 44,801 | |

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | | | | 463 | | | 463 | | | 462 | | | 465 | | | 460 | |

| FFO attributable to common stockholders | | | | $ | 22,317 | | | $ | 24,404 | | | $ | 23,473 | | | $ | 22,875 | | | $ | 23,829 | |

| Transaction related | | | | 101 | | | 150 | | | 105 | | | 277 | | | 194 | |

| | | | | | | | | | | | |

| Amortization of deferred financing costs | | | | 933 | | | 1,059 | | | 1,049 | | | 1,068 | | | 1,067 | |

| Amortization of deferred lease incentives, net | | | | (14) | | | 100 | | | 101 | | | 80 | | | 36 | |

| Equity-based compensation | | | | 687 | | | 689 | | | 526 | | | 603 | | | 444 | |

| Loss on extinguishment of debt, net | | | | — | | | 504 | | | — | | | — | | | — | |

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | | | | 29 | | | 29 | | | 29 | | | 29 | | | 28 | |

| Core FFO attributable to common stockholders | | | | $ | 24,053 | | | $ | 26,935 | | | $ | 25,283 | | | $ | 24,932 | | | $ | 25,598 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Amortization of above and below market leases, net | | | | (346) | | | (274) | | | (215) | | | (260) | | | (312) | |

| Straight-line rental revenue | | | | (1,369) | | | (2,275) | | | (2,684) | | | 2,911 | | | (699) | |

| Unconsolidated Joint Venture basis difference amortization | | | | 113 | | | 114 | | | 133 | | | 259 | | | 258 | |

| Capital expenditures and leasing costs | | | | (8,359) | | | (2,172) | | | (3,338) | | | (6,112) | | | (3,730) | |

| Other adjustments, net | | | | 66 | | | 74 | | | 131 | | | 74 | | | 63 | |

| Proportionate share of Unconsolidated Joint Venture adjustments for the items above, as applicable | | | | (40) | | | (41) | | | (40) | | | (54) | | | (59) | |

| FAD attributable to common stockholders | | | | $ | 14,118 | | | $ | 22,361 | | | $ | 19,270 | | | $ | 21,750 | | | $ | 21,119 | |

| | | | | | | | | | | | |

| Weighted-average shares outstanding - basic | | | | 56,543 | | | 56,680 | | | 56,642 | | | 56,644 | | | 56,635 | |

Effect of weighted-average dilutive securities (1) | | | | 26 | | | 11 | | | 18 | | | — | | | — | |

| Weighted-average shares outstanding - diluted | | | | 56,569 | | | 56,691 | | | 56,660 | | | 56,644 | | | 56,635 | |

| | | | | | | | | | | | |

| FFO attributable to common stockholders per diluted share | | | | $ | 0.39 | | | $ | 0.43 | | | $ | 0.41 | | | $ | 0.40 | | | $ | 0.42 | |

| Core FFO attributable to common stockholders per diluted share | | | | $ | 0.43 | | | $ | 0.48 | | | $ | 0.45 | | | $ | 0.44 | | | $ | 0.45 | |

| FAD attributable to common stockholders per diluted share | | | | $ | 0.25 | | | $ | 0.39 | | | $ | 0.34 | | | $ | 0.38 | | | $ | 0.37 | |

___________________________________

(1)Dilutive securities include unvested restricted stock units net of assumed repurchases in accordance with the treasury stock method and exclude performance-based restricted stock units for which the thresholds have not been met by the end of the applicable reporting period. Such dilutive securities are not included when calculating net loss per diluted share applicable to the Company for the periods presented above, as the effect would be antidilutive.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 10

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

EBITDA, EBITDAre and Adjusted EBITDA (unaudited, in thousands) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2022 |

| Net loss attributable to common stockholders | | | | $ | (16,519) | | | $ | (15,730) | | | $ | (8,885) | | | $ | (18,970) | | | $ | (53,047) | |

| Adjustments: | | | | | | | | | | | | |

| Interest expense | | | | 7,380 | | | 7,222 | | | 7,139 | | | 7,553 | | | 7,904 | |

| Depreciation and amortization | | | | 27,013 | | | 27,877 | | | 28,166 | | | 30,493 | | | 32,693 | |

| Provision for income taxes | | | | 160 | | | 185 | | | 160 | | | (282) | | | 164 | |

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | | | | 864 | | | 861 | | | 854 | | | 864 | | | 782 | |

| EBITDA | | | | $ | 18,898 | | | $ | 20,415 | | | $ | 27,434 | | | $ | 19,658 | | | $ | (11,504) | |

| Gain on disposition of real estate assets | | | | (18) | | | — | | | — | | | (1,293) | | | (1,059) | |

| Impairment of real estate | | | | 11,403 | | | 11,819 | | | 3,754 | | | 12,198 | | | 44,801 | |

| | | | | | | | | | | | |

| EBITDAre | | | | $ | 30,283 | | | $ | 32,234 | | | $ | 31,188 | | | $ | 30,563 | | | $ | 32,238 | |

| Transaction related | | | | 101 | | | 150 | | | 105 | | | 277 | | | 194 | |

| | | | | | | | | | | | |

| Amortization of above and below market leases, net | | | | (346) | | | (274) | | | (215) | | | (260) | | | (312) | |

| Amortization of deferred lease incentives, net | | | | (14) | | | 100 | | | 101 | | | 80 | | | 36 | |

| Loss on extinguishment of debt, net | | | | — | | | 504 | | | — | | | — | | | — | |

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | | | | (7) | | | (8) | | | (7) | | | (8) | | | (7) | |

| Adjusted EBITDA | | | | $ | 30,017 | | | $ | 32,706 | | | $ | 31,172 | | | $ | 30,652 | | | $ | 32,149 | |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 11

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Capital Structure (unaudited, dollars and shares in thousands, except per share amounts) |

|

| | | | | | | | | | | |

| | Common equity | 34.3% |

| | | |

| | Mortgages payable | 41.9% |

| | | |

| | Credit facility revolver (4) | 20.6% |

| | | |

| | Proportionate share of Unconsolidated Joint Venture Debt | 3.2% |

Fixed vs. Variable Rate Debt

| | | | | |

| |

| Fixed and Swapped to Fixed | 100.0 | % |

Variable (4) | — | % |

| | | | | | | | | | | | | | | | | |

| Orion Capitalization Table | | |

| | | | | September 30, 2023 |

| Common stock outstanding | | | | 55,780 |

| Stock price | | | | | $ | 5.21 |

| Implied Equity Market Capitalization | | $ | 290,614 |

| | | | | |

| Wtd. Avg. Maturity

(Years) | | Interest Rate (1) | | September 30, 2023 |

| Mortgages payable | 3.4 | | 4.97 | % | | $ | 355,000 |

Proportionate share of Unconsolidated Joint Venture Debt (2) | 1.2 | | 5.19 | % | | 27,332 |

| Total secured debt | 3.2 | | 4.99 | % | | $ | 382,332 |

| | | | | |

Total unsecured credit facility revolver (3) (4) | 2.6 | | 3.92% | | $ | 175,000 |

| | | | | |

| | | | | |

| Total Principal Outstanding | 3.0 | | 4.65 | % | | $ | 557,332 |

| | | | | |

| Total Capitalization | | $ | 847,946 |

| Cash and cash equivalents | | 32,286 |

| Restricted cash deposited with credit facility lenders | | 33,198 |

| Proportionate share of Unconsolidated Joint Venture cash and cash equivalents | | 708 |

| Enterprise Value | | $ | 781,754 |

| | |

| Net Debt/Enterprise Value | | 62.8 | % |

| Net Debt/Gross Real Estate Investments | | 28.9 | % |

| Fixed Charge Coverage Ratio | | 4.40x |

Liquidity (5) | | $ | 316,192 |

| Net Debt/Annualized Adjusted EBITDA | | 4.09x |

___________________________________

(1)Interest rate for variable rate debt represents the interest rate in effect as of September 30, 2023.

(2)The Unconsolidated Joint Venture mortgages payable have a variable interest rate which is determined, at the election of the borrower, on the basis of Daily Simple SOFR or a base rate, in the case of a SOFR loan, plus 1.60% per annum, and in the case of a base rate loan, plus 0.50% per annum; however, the Unconsolidated Joint Venture has entered into an interest rate swap agreement which effectively fixes the interest rate on the mortgage notes at 5.19% per annum until May 27, 2024.

(3)Under the related loan agreements, these borrowings which are secured only by a pledge of equity interests are treated as unsecured indebtedness. The Company's otherwise unencumbered properties are part of the unencumbered property pool under the related loan agreements and therefore, generally are not available to simultaneously serve as collateral under other borrowings.

(4)The credit facility revolver matures on November 12, 2024 with an option to extend the maturity an additional 18 months to May 12, 2026. This table assumes exercise of the extension option. There was $175.0 million outstanding on the credit facility revolver as of September 30, 2023 and it is a variable rate facility with the interest rate determined, at the election of the borrower, on the basis of Daily Simple SOFR, Term SOFR or a base rate, in the case of a SOFR loan, plus 3.35% per annum, and in the case of a base rate loan, plus 2.25% per annum; however, the Company has entered into interest rate swap agreements which effectively fixes the interest rate on the notional amount of $175.0 million at 3.92% per annum until November 12, 2023. Upon the scheduled expiration of the interest rate swap agreements, the Company's borrowing cost on the credit facility revolver will no longer be effectively fixed, but rather will float and, therefore, the Company's borrowing cost on the credit facility revolver will immediately shift to prevailing short-term interest rates based on the benchmark and applicable margin described above, and the Company will be exposed to interest rate fluctuations on these borrowings.

(5)Liquidity represents cash and cash equivalents of $33.0 million, including the Company's pro rata share of cash from the Unconsolidated Joint Venture, as well as $250.0 million available capacity on our $425.0 million credit facility revolver as of September 30, 2023. Also includes $33.2 million of restricted cash deposited with the credit facility lenders that will, in accordance with the terms of the credit facility revolver, be used to prepay borrowings thereunder upon the scheduled expiration in November 2023 (or earlier termination) of the Company's interest rate swap agreements, and thereby create an equal amount of additional available capacity under the credit facility revolver.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 12

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Debt Detail (unaudited, dollars in thousands) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Principal Payments Due | | Total | | 2023 | | 2024 | | 2025 | | Thereafter |

Credit facility revolver (1) | | $ | 175,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 175,000 | |

| Mortgages payable | | 355,000 | | | — | | | — | | | — | | | 355,000 | |

| Proportionate share of Unconsolidated Joint Venture debt | | 27,332 | | | — | | | 27,332 | | | — | | | — | |

| Total Principal Outstanding | | $ | 557,332 | | | $ | — | | | $ | 27,332 | | | $ | — | | | $ | 530,000 | |

| | | | | | | | | | | | | | | | | | | | |

| Debt Type | | Percentage of Principal Outstanding | | Interest Rate | | Weighted-Average Years to Maturity |

Credit facility revolver (1) | | 31.4 | % | | 3.92 | % | | 2.6 |

| Mortgages payable | | 63.7 | % | | 4.97 | % | | 3.4 |

| Proportionate share of Unconsolidated Joint Venture debt | | 4.9 | % | | 5.19 | % | | 1.2 |

| Total | | 100.0 | % | | 4.65 | % | | 3.0 |

| | | | | | | | | | | | | | | | | | | | |

| Debt Type | | Percentage of Principal Outstanding | | Weighted-Average Interest Rate | | Weighted-Average Years to Maturity |

| Total unsecured debt | | 31.4 | % | | 3.92 | % | | 2.6 |

| Total secured debt | | 68.6 | % | | 4.99 | % | | 3.2 |

| Total | | 100.0 | % | | 4.65 | % | | 3.0 |

| | | | | | |

Total fixed-rate and swapped to fixed-rate debt (1) | | 100.0 | % | | 4.65 | % | | 3.0 |

Total variable-rate debt (1) | | — | % | | N/A | | N/A |

| Total | | 100.0 | % | | 4.65 | % | | 3.0 |

___________________________________

(1)The credit facility revolver matures on November 12, 2024 with an option to extend the maturity an additional 18 months to May 12, 2026. This table assumes exercise of the extension option. There was $175.0 million outstanding on the credit facility revolver as of September 30, 2023 and it is a variable rate facility with the interest rate determined, at the election of the borrower, on the basis of Daily Simple SOFR, Term SOFR or a base rate, in the case of a SOFR loan, plus 3.35% per annum, and in the case of a base rate loan, plus 2.25% per annum; however, the Company has entered into interest rate swap agreements which effectively fixes the interest rate on the notional amount of $175.0 million at 3.92% per annum until November 12, 2023. Upon the scheduled expiration of the interest rate swap agreements, the Company's borrowing cost on the credit facility revolver will no longer be effectively fixed, but rather will float and, therefore, the Company's borrowing cost on the credit facility revolver will immediately shift to prevailing short-term interest rates based on the benchmark and applicable margin described above, and the Company will be exposed to interest rate fluctuations on these borrowings.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 13

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Ratio Analysis (unaudited, dollars in thousands) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2022 |

| Interest Coverage Ratio | | | | | | | | | | | | |

Interest Expense, excluding non-cash amortization (1) | | | | $ | 6,818 | | $ | 6,529 | | $ | 6,453 | | $ | 6,852 | | $ | 7,131 |

Adjusted EBITDA (2) | | | | 30,017 | | 32,706 | | 31,172 | | 30,652 | | 32,149 |

| Interest Coverage Ratio | | | | 4.40x | | 5.01x | | 4.83x | | 4.47x | | 4.51x |

| | | | | | | | | | | | |

| Fixed Charge Coverage Ratio | | | | | | | | | | | | |

Interest Expense, excluding non-cash amortization (1) | | | | $ | 6,818 | | $ | 6,529 | | $ | 6,453 | | $ | 6,852 | | $ | 7,131 |

| Secured debt principal amortization | | | | — | | — | | — | | — | | — |

| Total fixed charges | | | | 6,818 | | 6,529 | | 6,453 | | 6,852 | | 7,131 |

Adjusted EBITDA (2) | | | | 30,017 | | 32,706 | | 31,172 | | 30,652 | | 32,149 |

| Fixed Charge Coverage Ratio | | | | 4.40x | | 5.01x | | 4.83x | | 4.47x | | 4.51x |

___________________________________

(1)Refer to the Statements of Operations section for interest expense calculated in accordance with GAAP and to the Definitions section for the required reconciliation to the most directly comparable GAAP financial measure.

(2)Refer to the Statements of Operations section for net loss calculated in accordance with GAAP and to the EBITDAre and Adjusted EBITDA section for the required reconciliation to the most directly comparable GAAP financial measure.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2022 |

| Net Debt Ratios | | | | | | | | | | |

Net Debt (1) | | $ | 491,140 | | $ | 514,418 | | $ | 532,850 | | $ | 536,122 | | $ | 564,292 |

Adjusted EBITDA (2) | | 120,068 | | 130,824 | | 124,688 | | 132,210 | | 128,596 |

| Net Debt to Adjusted EBITDA Ratio | | 4.09x | | 3.93x | | 4.27x | | 4.06x | | 4.39x |

| | | | | | | | | | |

Net Debt (1) | | $ | 491,140 | | $ | 514,418 | | $ | 532,850 | | $ | 536,122 | | $ | 564,292 |

Gross Real Estate Investments (1) | | 1,698,387 | | 1,716,594 | | 1,734,559 | | 1,743,969 | | 1,766,600 |

| Net Debt Leverage Ratio | | 28.9 | % | | 30.0 | % | | 30.7 | % | | 30.7 | % | | 31.9 | % |

| | | | | | | | | | |

| Unencumbered Assets/Real Estate Assets | | | | | | | | | | |

Unencumbered Gross Real Estate Investments (1) | | $ | 1,092,464 | | $ | 1,112,811 | | $ | 1,131,272 | | $ | 1,141,035 | | $ | 1,165,310 |

Gross Real Estate Investments (1) | | 1,698,387 | | 1,716,594 | | 1,734,559 | | 1,743,969 | | 1,766,600 |

| Unencumbered Asset Ratio | | 64.3 | % | | 64.8 | % | | 65.2 | % | | 65.4 | % | | 66.0 | % |

___________________________________

(1)Refer to the Balance Sheets section for total debt and real estate investments, at cost calculated in accordance with GAAP and to the Definitions section for the required reconciliation to the most directly comparable GAAP financial measure. The Company's otherwise unencumbered properties are part of the unencumbered property pool under the related loan agreements and therefore, generally are not available to simultaneously serve as collateral under other borrowings.

(2)Adjusted EBITDA for the quarters ended September 30, 2023, June 30, 2023, March 31, 2023, and September 30, 2022 has been annualized for the purpose of this calculation.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 14

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Credit Facility Revolver Covenants (unaudited) |

|

The following is a summary of financial covenants for the Company's credit facility revolver as defined and calculated per the terms of the facility's credit agreement. These calculations are presented to investors to show the Company's compliance with the financial covenants and are not measures of our liquidity or performance. As of September 30, 2023, the Company believes it is in compliance with these covenants based on the covenant limits and calculations in place at that time.

| | | | | | | | | | | | | | |

| Credit Facility Revolver Financial Covenants | | Required | | September 30, 2023 |

| Ratio of total indebtedness to total asset value | | ≤ 60% | | 38.3% |

| Ratio of adjusted EBITDA to fixed charges | | ≥ 1.5x | | 4.23x |

| Ratio of secured indebtedness to total asset value | | ≤ 40% | | 25.0% |

| Ratio of unsecured indebtedness to unencumbered asset value | | ≤ 60% (1) | | 14.9% |

| Ratio of unencumbered adjusted NOI to unsecured interest expense | | ≥ 2.00x | | 10.74x |

| Unencumbered asset value | | ≥ $600.0 million | | $832.5 million |

___________________________________(1)If the ratio of unsecured indebtedness to unencumbered asset value exceeds 35% as of the end of two consecutive fiscal quarters, the Company will be required, within 90 days and subject to cure rights, to grant the administrative agent a first priority lien on all the properties included in the pool of unencumbered assets (other than properties identified for disposition by the Company so long as such properties are sold within one year of such identification).

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 15

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Net Operating Income (NOI) and Cash NOI (unaudited, dollars in thousands) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2022 |

| Rental revenue: | | | | | | | | | | | | |

| Cash rental revenue | | | | 35,491 | | | 36,410 | | | 36,104 | | | 37,209 | | | 38,987 | |

| Fixed reimbursements | | | | 1,737 | | | 1,399 | | | 1,384 | | | 1,406 | | | 1,428 | |

| Variable reimbursements | | | | 9,203 | | | 10,679 | | | 8,482 | | | 9,081 | | | 9,027 | |

| Straight-line rental revenue | | | | 1,369 | | | 2,275 | | | 2,684 | | | (2,911) | | | 699 | |

| Amortization of above and below market leases, net | | | | 346 | | | 274 | | | 215 | | | 260 | | | 312 | |

| Amortization of deferred lease incentives, net | | | | 14 | | | (100) | | | (101) | | | (80) | | | (36) | |

| Other rental revenue | | | | 716 | | | 887 | | | 1,222 | | | 5,132 | | | 1,163 | |

| Total rental revenue | | | | 48,876 | | | 51,824 | | | 49,990 | | | 50,097 | | | 51,580 | |

| Property operating expense | | | | (15,506) | | | (15,487) | | | (15,344) | | | (15,746) | | | (15,303) | |

| NOI | | | | 33,370 | | | 36,337 | | | 34,646 | | | 34,351 | | | 36,277 | |

| Adjustments: | | | | | | | | | | | | |

| Straight-line rental revenue | | | | (1,369) | | | (2,275) | | | (2,684) | | | 2,911 | | | (699) | |

| Amortization of above and below market leases, net | | | | (346) | | | (274) | | | (215) | | | (260) | | | (312) | |

| Amortization of deferred lease incentives, net | | | | (14) | | | 100 | | | 101 | | | 80 | | | 36 | |

| Other non-cash adjustments | | | | 47 | | | 48 | | | 48 | | | 51 | | | 50 | |

| Proportionate share of Unconsolidated Joint Venture Cash NOI | | | | 863 | | | 861 | | | 862 | | | 833 | | | 848 | |

| Cash NOI | | | | $ | 32,551 | | | $ | 34,797 | | | $ | 32,758 | | | $ | 37,966 | | | $ | 36,200 | |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 16

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Leasing Activity (unaudited, dollars and square feet in thousands) |

|

During the nine months ended September 30, 2023, we entered into new and renewal leases as summarized in the following table:

| | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2023 |

| | New Leases | | Renewals | | Total |

| Rentable square feet leased | | 18 | | 111 | | 129 |

Weighted average rental rate change (cash basis) (1) (2) | | (19.8) | % | | 17.3 | % | | 13.5 | % |

Tenant leasing costs and concession commitments (3) | | $ | 748 | | | $ | 1,065 | | | $ | 1,813 | |

| Tenant leasing costs and concession commitments per rentable square foot | | $ | 41.38 | | | $ | 9.62 | | | $ | 14.09 | |

| Weighted average lease term (by rentable square feet) (years) | | 7.8 | | 9.8 | | 9.5 |

| Tenant leasing costs and concession commitments per rentable square foot per year | | $ | 5.29 | | | $ | 0.98 | | | $ | 1.48 | |

____________________________________

(1)Represents weighted average percentage increase or decrease in (i) the annualized monthly cash amount charged to the applicable tenants (including monthly base rent receivables and certain contractually obligated reimbursements by the applicable tenants, which may include estimates) as of the commencement date of the new lease term (excluding any full or partial rent abatement period) compared to (ii) the annualized monthly cash amount charged to the applicable tenants (including the monthly base rent receivables and certain contractually obligated reimbursements by the applicable tenants, which may include estimates) as of the expiration date of the prior lease term. If a space has been vacant for more than 12 months prior to the execution of a new lease, the lease will be excluded from this calculation.

(2)Excludes one new lease for approximately 4,000 square feet of space that had been vacant for more than 12 months at the time the new lease was executed.

(3)Includes commitments for tenant improvement allowances and base building allowances, leasing commissions and free rent (includes estimates of property operating expenses, where applicable).

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 17

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Vacant Property Operating Expenses (unaudited, in thousands for the nine months ended September 30, 2023) |

|

| | | | | | | | | | | | | | |

| | Square Feet | | Total Expenses |

| Fully vacant - full period | | 637 | | $2,866 |

Fully vacant - disposed and partial period (1) | | 1,085 | | 3,565 |

Fully vacant subtotal (2) | | 1,722 | | $6,431 |

Partially vacant properties (3) | | 345 | | 1,778 |

| Total | | 2,067 | | $8,209 |

____________________________________

(1)Represents eight properties that became vacant during the nine months ended September 30, 2023 and one vacant property that was disposed during the nine months ended September 30, 2023.

(2)The Company had 13 fully vacant properties as of September 30, 2023, including the six property former Walgreens campus in Deerfield, Illinois. All expenses are a component of property operating expenses in the consolidated statements of operations.

(3)The Company does not record property operating expenses at the suite level; therefore, the total expenses for the nine months ended September 30, 2023 for partially vacant properties are estimated by multiplying the vacant square feet of the partially vacant properties by the total annualized expenses per square foot for fully vacant properties and prorating for the nine months ended September 30, 2023.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 18

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Dispositions (unaudited, square feet and dollars in thousands) |

|

The following table summarizes the Company's disposition activity during the three and nine months ended September 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Date Sold | | Property Location | | Square Feet | | Gross Sale Price | | Lease Term (Years) |

| 07/06/2023 | | Berkeley, MO | | 227 | | $9,650 | | Vacant |

| 08/10/2023 | | New Port Richey, FL | | 47 | | 4,400 | | Vacant |

| Total | | 274 | | $14,050 | | |

The following table summarizes the Company's disposition activity following the nine months ended September 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Date Sold | | Property Location | | Square Feet | | Gross Sale Price | | Lease Term (Years) |

| 10/23/2023 | | Schaumburg, IL | | 178 | | $1,375 | | Vacant |

| | | | | | |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 19

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

Diversification Statistics: Real Estate Portfolio (unaudited, percentages based on portfolio Annualized Base Rent as of September 30, 2023, other than occupancy rate which is based on square footage as of September 30, 2023) |

|

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

| | | | | | | | |

Statistics (square feet in thousands) |

| | |

| Operating Properties | | 79 | |

| Unconsolidated Joint Venture Properties | | 6 | |

| Rentable Square Feet | | 9,459 | |

| Occupancy Rate | | 80.5 | % |

| Weighted Average Remaining Lease Term | | 3.9 | |

| Investment-Grade Tenants | | 72.0 | % |

| | |

| NN leases | | 69.6 | % |

| NNN leases | | 11.9 | % |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 20

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Tenants Comprising Over 1% of Annualized Base Rent (unaudited, square feet and dollars in thousands as of September 30, 2023) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tenant | | Number of Leases | | Leased Square Feet | | Square Feet as a % of Total Portfolio | | Annualized Base Rent | | Annualized Base Rent as a % of Total Portfolio | | Credit Rating |

| General Services Administration | | 16 | | | 734 | | | 7.8 | % | | $ | 19,283 | | | 13.3 | % | | AA+ |

| Merrill Lynch | | 1 | | | 482 | | | 5.1 | % | | 12,224 | | | 8.4 | % | | A- |

| Highmark Western & Northeastern NY | | 1 | | | 430 | | | 4.5 | % | | 8,450 | | | 5.8 | % | | NR |

| RSA Security | | 2 | | | 328 | | | 3.5 | % | | 7,221 | | | 5.0 | % | | BBB |

| Cigna/Express Scripts | | 3 | | | 365 | | | 3.9 | % | | 6,856 | | | 4.7 | % | | A- |

| Coterra Energy | | 1 | | | 309 | | | 3.3 | % | | 5,762 | | | 4.0 | % | | BBB |

| Novartis | | 1 | | | 176 | | | 1.9 | % | | 4,995 | | | 3.4 | % | | AA- |

| MDC Holdings Inc. | | 1 | | | 144 | | | 1.5 | % | | 4,299 | | | 3.0 | % | | BBB- |

| T-Mobile | | 3 | | | 217 | | | 2.3 | % | | 3,937 | | | 2.7 | % | | BBB |

| Charter Communications | | 2 | | | 264 | | | 2.8 | % | | 3,745 | | | 2.6 | % | | BB+ |

| Top Ten Tenants | | 31 | | | 3,449 | | | 36.6 | % | | 76,772 | | | 52.9 | % | | |

| Remaining Tenants: | | | | | | | | | | | | |

| Banner Life Insurance | | 1 | | | 116 | | | 1.2 | % | | 3,581 | | | 2.5 | % | | A |

| Inform Diagnostics | | 1 | | | 172 | | | 1.8 | % | | 3,551 | | | 2.5 | % | | NR |

| Encompass Health | | 1 | | | 65 | | | 0.7 | % | | 3,436 | | | 2.4 | % | | BB- |

| Collins Aerospace | | 1 | | | 207 | | | 2.2 | % | | 3,369 | | | 2.3 | % | | BBB+ |

| Home Depot/HD Supply | | 2 | | | 153 | | | 1.6 | % | | 3,120 | | | 2.2 | % | | A |

| AT&T | | 1 | | | 203 | | | 2.1 | % | | 2,921 | | | 2.0 | % | | BBB |

| Linde | | 1 | | | 175 | | | 1.9 | % | | 2,714 | | | 1.9 | % | | A |

| Maximus | | 2 | | | 168 | | | 1.8 | % | | 2,549 | | | 1.8 | % | | BB+ |

| Citigroup | | 1 | | | 64 | | | 0.7 | % | | 2,459 | | | 1.7 | % | | BBB+ |

| CVS/Aetna | | 1 | | | 127 | | | 1.3 | % | | 2,259 | | | 1.6 | % | | BBB |

| Hasbro | | 1 | | | 136 | | | 1.4 | % | | 2,243 | | | 1.5 | % | | BBB |

| Ingram Micro | | 1 | | | 200 | | | 2.1 | % | | 2,197 | | | 1.5 | % | | BB- |

| Novus International | | 1 | | | 96 | | | 1.0 | % | | 2,022 | | | 1.4 | % | | NR |

| Pulte Mortgage | | 1 | | | 95 | | | 1.0 | % | | 2,005 | | | 1.4 | % | | BBB |

| NetJets | | 1 | | | 140 | | | 1.5 | % | | 1,990 | | | 1.4 | % | | NR |

| Elementis | | 1 | | | 66 | | | 0.7 | % | | 1,980 | | | 1.4 | % | | NR |

FedEx (1) | | 2 | | | 352 | | | 3.7 | % | | 1,744 | | | 1.2 | % | | BBB |

| General Electric | | 1 | | | 152 | | | 1.6 | % | | 1,663 | | | 1.1 | % | | BBB+ |

| AGCO | | 1 | | | 126 | | | 1.3 | % | | 1,607 | | | 1.1 | % | | BBB- |

| Intermec | | 1 | | | 81 | | | 0.9 | % | | 1,459 | | | 1.0 | % | | A |

| Abbott Laboratories | | 1 | | | 131 | | | 1.4 | % | | 1,379 | | | 1.0 | % | | AA- |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total | | 55 | | | 6,474 | | | 68.5 | % | | $ | 127,020 | | | 87.8 | % | | |

____________________________________

(1)Includes one lease where FedEx was in holdover tenancy at the end of the quarter and holdover rent has been excluded from the Annualized Base Rent calculation.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 21

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Tenant Industry Diversification (unaudited, square feet and dollars in thousands as of September 30, 2023) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Industry | | Number of Leases (1) | | Leased Square Feet | | Leased Square Feet as a % of Total Portfolio | | Annualized Base Rent | | Annualized Base Rent as a % of Total Portfolio |

| Health Care Equipment & Services | | 12 | | | 1,109 | | | 11.7 | % | | $ | 21,354 | | | 14.7 | % |

| Government & Public Services | | 18 | | | 778 | | | 8.2 | % | | 19,831 | | | 13.7 | % |

| Financial Institutions | | 3 | | | 616 | | | 6.5 | % | | 15,479 | | | 10.7 | % |

| Insurance | | 3 | | | 600 | | | 6.3 | % | | 13,292 | | | 9.2 | % |

| Capital Goods | | 10 | | | 845 | | | 8.9 | % | | 12,572 | | | 8.7 | % |

| Software & Services | | 6 | | | 638 | | | 6.7 | % | | 11,668 | | | 8.0 | % |

| Consumer Durables & Apparel | | 3 | | | 375 | | | 4.0 | % | | 8,546 | | | 5.9 | % |

| Telecommunication Services | | 5 | | | 419 | | | 4.4 | % | | 6,858 | | | 4.7 | % |

| Materials | | 4 | | | 366 | | | 3.9 | % | | 5,852 | | | 4.0 | % |

| Energy | | 1 | | | 309 | | | 3.3 | % | | 5,762 | | | 4.0 | % |

| Top Ten Tenant Industries | | 65 | | | 6,055 | | | 63.9 | % | | 121,214 | | | 83.6 | % |

| Remaining Tenant Industries: | | | | | | | | | | |

| Pharmaceuticals, Biotechnology & Life Sciences | | 1 | | | 176 | | | 1.9 | % | | 4,995 | | | 3.4 | % |

| Commercial & Professional Services | | 10 | | | 295 | | | 3.1 | % | | 4,719 | | | 3.3 | % |

| Transportation | | 5 | | | 541 | | | 5.7 | % | | 4,490 | | | 3.1 | % |

| Media & Entertainment | | 2 | | | 264 | | | 2.8 | % | | 3,745 | | | 2.6 | % |

| Retailing | | 3 | | | 157 | | | 1.7 | % | | 3,196 | | | 2.2 | % |

| Food, Beverage & Tobacco | | 1 | | | 96 | | | 1.0 | % | | 2,022 | | | 1.4 | % |

| Utilities | | 1 | | | 26 | | | 0.3 | % | | 394 | | | 0.3 | % |

| Real Estate | | 1 | | | 4 | | | — | % | | 86 | | | 0.1 | % |

| Consumer Services | | 2 | | | 5 | | | 0.1 | % | | 54 | | | — | % |

| | | | | | | | | | |

| Total | | 91 | | | 7,619 | | | 80.5 | % | | $ | 144,915 | | | 100.0 | % |

__________________________________

(1) The Company has certain properties that are subject to multiple leases.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 22

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

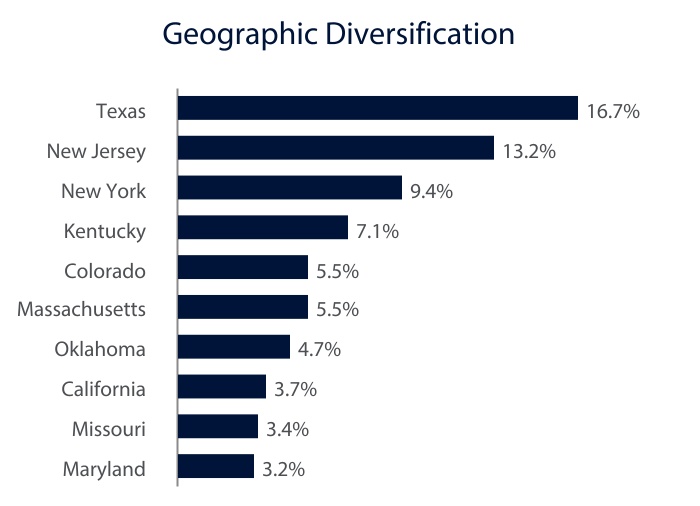

Property Geographic Diversification (unaudited, square feet and dollars in thousands as of September 30, 2023) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Location | | Number of Properties | | Rentable Square Feet | | Square Feet as a % of Total Portfolio | | Annualized Base Rent | | Annualized Base Rent as a % of Total Portfolio |

| Texas | | 15 | | | 1,353 | | | 14.3 | % | | $ | 24,239 | | | 16.7 | % |

| New Jersey | | 3 | | | 724 | | | 7.6 | % | | 19,199 | | | 13.2 | % |

| New York | | 5 | | | 781 | | | 8.2 | % | | 13,691 | | | 9.4 | % |

| Kentucky | | 2 | | | 458 | | | 4.8 | % | | 10,299 | | | 7.1 | % |

| Colorado | | 4 | | | 571 | | | 6.0 | % | | 7,967 | | | 5.5 | % |

| Massachusetts | | 2 | | | 378 | | | 4.0 | % | | 7,933 | | | 5.5 | % |

| Oklahoma | | 3 | | | 585 | | | 6.2 | % | | 6,791 | | | 4.7 | % |

| California | | 3 | | | 244 | | | 2.6 | % | | 5,310 | | | 3.7 | % |

| Missouri | | 3 | | | 303 | | | 3.2 | % | | 4,917 | | | 3.4 | % |

| Maryland | | 2 | | | 236 | | | 2.5 | % | | 4,646 | | | 3.2 | % |

| Top Ten States | | 42 | | | 5,633 | | | 59.4 | % | | 104,992 | | | 72.4 | % |

| Remaining States: | | | | | | | | | | |

| Tennessee | | 4 | | | 240 | | | 2.5 | % | | 4,615 | | | 3.2 | % |

| Georgia | | 3 | | | 284 | | | 3.0 | % | | 4,601 | | | 3.2 | % |

| Virginia | | 2 | | | 240 | | | 2.5 | % | | 4,523 | | | 3.1 | % |

| Ohio | | 4 | | | 500 | | | 5.3 | % | | 3,520 | | | 2.4 | % |

| Rhode Island | | 2 | | | 206 | | | 2.2 | % | | 3,040 | | | 2.1 | % |

| South Carolina | | 1 | | | 64 | | | 0.7 | % | | 2,459 | | | 1.7 | % |

| Wisconsin | | 1 | | | 155 | | | 1.6 | % | | 2,299 | | | 1.6 | % |

| Arizona | | 2 | | | 215 | | | 2.3 | % | | 2,216 | | | 1.5 | % |

| Illinois | | 9 | | | 916 | | | 9.7 | % | | 2,174 | | | 1.5 | % |

| Iowa | | 2 | | | 92 | | | 1.0 | % | | 1,955 | | | 1.4 | % |

| Nebraska | | 2 | | | 180 | | | 1.9 | % | | 1,563 | | | 1.1 | % |

| Pennsylvania | | 2 | | | 233 | | | 2.5 | % | | 1,316 | | | 0.9 | % |

| Oregon | | 1 | | | 69 | | | 0.7 | % | | 1,142 | | | 0.8 | % |

| West Virginia | | 1 | | | 63 | | | 0.7 | % | | 1,130 | | | 0.8 | % |

| Kansas | | 2 | | | 196 | | | 2.1 | % | | 1,044 | | | 0.7 | % |

| Idaho | | 2 | | | 45 | | | 0.5 | % | | 1,035 | | | 0.7 | % |

| Indiana | | 1 | | | 83 | | | 0.9 | % | | 570 | | | 0.4 | % |

| Minnesota | | 1 | | | 39 | | | 0.4 | % | | 493 | | | 0.3 | % |

| Florida | | 1 | | | 6 | | | 0.1 | % | | 228 | | | 0.2 | % |

| Total | | 85 | | | 9,459 | | | 100.0 | % | | $ | 144,915 | | | 100.0 | % |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 23

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

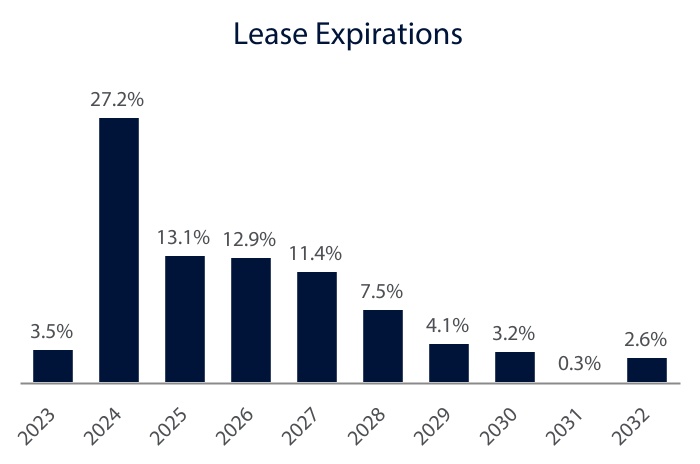

Lease Expirations (unaudited, square feet and dollars in thousands as of September 30, 2023) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year of Expiration | | Number of Leases

Expiring (1) | | Leased

Square Feet | | Leased Square Feet as a % of Total Portfolio | | Annualized Base Rent | | Annualized Base Rent as a % of Total Portfolio |

| 2023 | | 2 | | | 186 | | | 2.0 | % | | $ | 5,288 | | | 3.5 | % |

| 2024 | | 16 | | | 1,911 | | | 20.2 | % | | 39,379 | | | 27.2 | % |

| 2025 | | 13 | | | 1,044 | | | 11.0 | % | | 18,956 | | | 13.1 | % |

| 2026 | | 15 | | | 804 | | | 8.5 | % | | 18,629 | | | 12.9 | % |

| 2027 | | 14 | | | 1,002 | | | 10.5 | % | | 16,504 | | | 11.4 | % |

| 2028 | | 11 | | | 595 | | | 6.3 | % | | 10,907 | | | 7.5 | % |

| 2029 | | 4 | | | 396 | | | 4.2 | % | | 5,968 | | | 4.1 | % |

| 2030 | | 2 | | | 98 | | | 1.0 | % | | 4,591 | | | 3.2 | % |

| 2031 | | 1 | | | 11 | | | 0.1 | % | | 429 | | | 0.3 | % |

| 2032 | | 3 | | | 300 | | | 3.2 | % | | 3,808 | | | 2.6 | % |

| Thereafter | | 9 | | | 1,010 | | | 10.7 | % | | 20,456 | | | 14.2 | % |

| Subtotal | | 90 | | | 7,357 | | | 77.7 | % | | 144,915 | | | 100.0 | % |

| Month-to-Month | | 1 | | | 262 | | | 2.8 | % | | — | | | — | % |

| Total | | 91 | | | 7,619 | | | 80.5 | % | | $ | 144,915 | | | 100.0 | % |

__________________________________

(1) The Company has certain properties that are subject to multiple leases.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 24

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Lease Summary (unaudited, square feet and dollars in thousands as of September 30, 2023) |

|

Rent Escalations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Leases (1) | | Leased

Square Feet | | Leased Square Feet as a % of Total Portfolio | | Annualized Base Rent | | Annualized Base Rent as a % of Total Portfolio |

| Fixed Dollar or Percent Increase | | 67 | | | 6,410 | | | 67.8 | % | | $ | 120,956 | | | 83.5 | % |

| Flat | | 7 | | | 113 | | | 1.1 | % | | 1,794 | | | 1.2 | % |

| GSA CPI | | 14 | | | 689 | | | 7.3 | % | | 18,248 | | | 12.6 | % |

| CPI | | 2 | | | 145 | | | 1.5 | % | | 3,917 | | | 2.7 | % |

| Month-to-Month | | 1 | | | 262 | | | 2.8 | % | | — | | | — | % |

| Total | | 91 | | | 7,619 | | | 80.5 | % | | $ | 144,915 | | | 100.0 | % |

Tenant Expense Obligation

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Leases (1) | | Leased

Square Feet | | Leased Square Feet as a % of Total Portfolio | | Annualized Base Rent | | Annualized Base Rent as a % of Total Portfolio |

| NN | | 58 | | | 5,586 | | | 59.1 | % | | $ | 100,799 | | | 69.6 | % |

| Modified Gross | | 19 | | | 977 | | | 10.2 | % | | 26,717 | | | 18.4 | % |

| NNN | | 11 | | | 1,048 | | | 11.1 | % | | 17,303 | | | 11.9 | % |

| Gross | | 3 | | | 8 | | | 0.1 | % | | 96 | | | 0.1 | % |

| Total | | 91 | | | 7,619 | | | 80.5 | % | | $ | 144,915 | | | 100.0 | % |

__________________________________

(1) The Company has certain properties that are subject to multiple leases.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 25

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Full Portfolio (1) (unaudited, as of September 30, 2023) |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Industry | | Address | | City | | State |

| | | | Food, Beverage & Tobacco | | 20 Missouri Research Park Drive | | St. Charles | | MO |

| | | | Commercial & Professional Services | | 4335 Paredes Line Road | | Brownsville | | TX |

| | | | Telecommunication Services | | 3750 Wheeler Road | | Augusta | | GA |

| | | | Telecommunication Services | | 4080 27th Court SE | | Salem | | OR |

| | | | Financial Institutions | | 11 Ewall Street | | Mount Pleasant | | SC |

| | | | Health Care Equipment & Services | | 8455 University Place Drive | | St. Louis | | MO |

| | | | Transportation | | 1475 Boettler Road | | Uniontown | | OH |

| | | | Government & Public Services | | 2305 Hudson Boulevard | | Brownsville | | TX |

| | | | Government & Public Services | | 257 Bosley Industrial Park | | Parkersburg | | WV |

| | | | Government & Public Services | | 2805 Pine Mill Road | | Paris | | TX |

| | | | Government & Public Services | | 4521 Thomas Jefferson Street | | Caldwell | | ID |

| | | | Government & Public Services | | 3381 U.S. Highway 277 | | Eagle Pass | | TX |

| | | | Government & Public Services | | 2475 Cliff Creek Crossing Drive | | Dallas | | TX |

| | | | Government & Public Services | | 3644 Avtech Parkway | | Redding | | CA |

| | | | Government & Public Services | | 5100 W 36th Street | | Minneapolis | | MN |

| | | | Government & Public Services | | 4551 State Route 11 (E) | | Malone | | NY |

| | | | Government & Public Services | | 2600 Voyager Avenue | | Sioux City | | IA |

| | | | Government & Public Services | | 135 Circle Lane | | Knoxville | | TN |

| | | | Health Care Equipment & Services | | 2304 State Highway 121 | | Bedford | | TX |

| | | | Vacant | | 5411 E. Williams Boulevard | | Tucson | | AZ |

| | | | Government & Public Services | | 3369 U.S. Highway 277 | | Eagle Pass | | TX |

| | | | Transportation | | 942 S. Shady Grove Road | | Memphis | | TN |

| | | | Transportation | | 4151 Bridgeway Avenue | | Columbus | | OH |

| | | | Vacant | | 1411 Lake Cook Road | | Deerfield | | IL |

| | | | Vacant | | 1415 Lake Cook Road | | Deerfield | | IL |

| | | | Vacant | | 1417 Lake Cook Road | | Deerfield | | IL |

| | | | Vacant | | 1419 Lake Cook Road | | Deerfield | | IL |

| | | | Vacant | | 1425 Lake Cook Road | | Deerfield | | IL |

| | | | Vacant | | 1435 Lake Cook Road | | Deerfield | | IL |

| | | | Capital Goods | | 601 Third Street SE | | Cedar Rapids | | IA |

| | | | Consumer Durables & Apparel | | 15 LaSalle Square | | Providence | | RI |

| | | | Materials | | 100 Sci Park Boulevard | | East Windsor | | NJ |

| | | | Media & Entertainment | | 6005 Fair Lakes Road | | East Syracuse | | NY |

| | | | Government & Public Services | | 310 Canaveral Groves Boulevard | | Cocoa | | FL |

| | | | Government & Public Services | | 103 & 104 Airport Road | | Grangeville | | ID |

| | | | Government & Public Services | | 2901 Alta Mesa Boulevard | | Fort Worth | | TX |

| | | | Government & Public Services | | 59 Dunning Way | | Plattsburgh | | NY |

| | | | Financial Institutions | | 480 Jefferson Boulevard | | Warwick | | RI |

| | | | Capital Goods | | 1800 Nelson Road | | Longmont | | CO |

| | | | Health Care Equipment & Services | | 1850 Norman Drive North | | Waukegan | | IL |

| | | | Health Care Equipment & Services | | 1333 - 1385 East Shaw Avenue | | Fresno | | CA |

| | | | Telecommunication Services | | 2270 Lakeside Boulevard | | Richardson | | TX |

| | | | Health Care Equipment & Services | | 5859 Farinon Drive | | San Antonio | | TX |

| | | | Energy | | 202 S. Cheyenne | | Tulsa | | OK |

| | | | Vacant | | 7475 S. Joliet Street | | Englewood | | CO |

| | | | Consumer Durables & Apparel | | 4340 & 4350 South Monaco Street | | Denver | | CO |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 26

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Industry | | Address | | City | | State |

| | | | Vacant | | 2250 Lakeside Boulevard | | Richardson | | TX |

| | | | Commercial & Professional Services | | 3833 Greenway Drive | | Lawrence | | KS |

| | | | Vacant | | 2201 Noria Road | | Lawrence | | KS |

| | | | Materials | | 1585 Sawdust Road | | The Woodlands | | TX |

| | | | Consumer Durables & Apparel | | 7390 S. Iola Street | | Englewood | | CO |

| | | | Vacant | | 41 Moores Road | | Malvern | | PA |

| | | | Media & Entertainment | | 1320 N. Dr. MLK Jr. Drive | | Milwaukee | | WI |

| | | | Telecommunication Services | | 695 Grassmere Park | | Nashville | | TN |

| | | | Commercial & Professional Services | | 1575 Sawdust Road | | The Woodlands | | TX |

| | | | Retailing | | 101 Riverview Parkway | | Santee | | CA |

| | | | Materials | | 6752 Baymeadow Drive | | Glen Burnie | | MD |

| | | | Health Care Equipment & Services | | 6655 North MacArthur Boulevard | | Irving | | TX |

| | | | Capital Goods | | 2087 East 71st Street | | Tulsa | | OK |

| | | | Government & Public Services | | 333 Scott Street | | Covington | | KY |

| | | | Software & Services | | 1759 Wehrle Dr | | Amherst | | NY |

| | | | Commercial & Professional Services | | 6377 Emerald Drive | | Dublin | | OH |

| | | | Capital Goods | | 22640 Davis Drive | | Sterling | | VA |

| | | | Capital Goods | | 1100 Atwater Drive, Lot 11A | | Malvern | | PA |

| | | | Health Care Equipment & Services | | 7353 Company Drive | | Indianapolis | | IN |

| | | | Health Care Equipment & Services | | 1640 Dallas Parkway | | Plano | | TX |

| | | | Capital Goods | | 1705 Kellie Drive | | Blair | | NE |

| | | | Vacant (2) | | 955 American Lane Unit 1 | | Schaumburg | | IL |

| | | | Vacant | | 3100 Quail Springs Parkway | | Oklahoma City | | OK |

| | | | Software & Services | | 777 Research Road | | Lincoln | | NE |

| | | | Insurance | | 249-257 West Genesee Street | | Buffalo | | NY |

| | | | Insurance | | 3275 Bennett Creek Avenue | | Urbana | | MD |

| | | | Health Care Equipment & Services | | 100 Airpark Center Drive East | | Nashville | | TN |

| | | | Retailing | | 3074 Chastain Meadows Parkway NW | | Kennesaw | | GA |

| | | | Capital Goods | | 4205 River Green Parkway | | Duluth | | GA |

| | | | Pharmaceuticals, Biotechnology & Life Sciences | | 8 Sylvan way | | Parsippany | | NJ |

| | | | Software & Services | | 174 & 176 Middlesex Turnpike | | Bedford | | MA |

| | | | Financial Institutions | | 1500-1600 Merrill Lynch Drive | | Hopewell | | NJ |

| | | | Health Care Equipment & Services | | 3003 N. 3rd Street | | Phoenix | | AZ |

| | | | Capital Goods | | 70 Mechanic Street | | Foxboro | | MA |

| | | | Health Care Equipment & Services | | 577 Aptakisic Road | | Lincolnshire | | IL |

| | | | Transportation | | 360 Westar Boulevard | | Westerville | | OH |

| | | | Software & Services | | 12975 Worldgate Drive | | Herndon | | VA |

| | | | Transportation | | 580 Atlas Air Way | | Erlanger | | KY |

| | | | Utilities | | 700 Market Street | | St. Louis | | MO |

| | | | | | | | | | |

__________________________________

(1)Includes the properties owned by the Company's Unconsolidated Joint Venture.

(2)Property was sold in October 2023.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 27

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Unconsolidated Joint Venture Investment Summary (unaudited, square feet and dollars in thousands) |

|

The following table summarizes the Company's investments in the Arch Street Unconsolidated Joint Venture as of September 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Legal Ownership Percentage (1) | | | Tenant Industry | | Pro Rata Share of Gross Real Estate Investments | | Pro Rata Share of Rentable Square Feet | | Pro Rata Share of Annualized Base Rent | | Pro Rata Share of Principal Outstanding | |

| Schneider Electric - Foxboro, MA | | 20% | | | Capital Goods | | $ | 8,336 | | | 50 | | | $ | 713 | | | $ | 5,090 | | |

| Sysmex - Lincolnshire, IL | | 20% | | | Health Care Equipment & Services | | 9,239 | | | 33 | | | 795 | | | 5,448 | | |

| DHL - Westerville, OH | | 20% | | | Transportation | | 6,676 | | | 29 | | | 439 | | | 3,972 | | |

| Peraton - Herndon, VA | | 20% | | | Software & Services | | 9,808 | | | 33 | | | 1,155 | | | 6,000 | | |

| Atlas Air - Erlanger, KY | | 20% | | | Transportation | | 5,330 | | | 20 | | | 317 | | | 3,162 | | |

| Spire Energy - St. Louis, MO | | 20% | | | Utilities | | 6,159 | | | 26 | | | 394 | | | 3,660 | | |

| | | | | | | $ | 45,548 | | | 191 | | | $ | 3,813 | | | $ | 27,332 | | |

__________________________________

(1)Legal ownership percentage may, at times, not equal the Company's economic interest because of various provisions in the joint venture agreement regarding capital contributions, distributions of cash flow based on capital account balances and allocations of profits and losses.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 28

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Definitions (unaudited, in thousands, except share and per share data) |

|

Annualized Base Rent is the monthly aggregate cash amount charged to tenants under our leases (including monthly base rent receivables and certain fixed contractually obligated reimbursements by our tenants), as of the final date of the applicable period, multiplied by 12, including the Company's pro rata share of such amounts related to the Unconsolidated Joint Venture. Annualized Base Rent is not indicative of future performance.

CPI refers to a lease in which base rent is adjusted based on changes in a consumer price index.

Credit Rating of a tenant refers to the Standard & Poor's or Moody's credit rating and such rating also may reflect the rating assigned by Standard & Poor's or Moody's to the lease guarantor or the parent company as applicable.

Double Net Lease ("NN") is a lease under which the tenant agrees to pay all operating expenses associated with the property (e.g., real estate taxes, insurance, maintenance), but excludes some or all major repairs (e.g., roof, structure, parking lot, in each case, as further defined in the applicable lease).

Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate ("EBITDAre") and Adjusted EBITDA

Due to certain unique operating characteristics of real estate companies, as discussed below, the National Association of Real Estate Investment Trusts, Inc. ("Nareit"), an industry trade group, has promulgated a supplemental performance measure known as Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate. Nareit defines EBITDAre as net income or loss computed in accordance with GAAP, adjusted for interest expense, income tax expense (benefit), depreciation and amortization, impairment write-downs on real estate, gains or losses from disposition of property and our pro rata share of EBITDAre adjustments related to the Unconsolidated Joint Venture. We calculated EBITDAre in accordance with Nareit's definition described above.

In addition to EBITDAre, we use Adjusted EBITDA as a non-GAAP supplemental performance measure to evaluate the operating performance of the Company. Adjusted EBITDA, as defined by the Company, represents EBITDAre, modified to exclude non-routine items such as transaction related expenses and spin related expenses. We also exclude certain non-cash items such as impairments of intangible and right of use assets, gains or losses on derivatives, gains or losses on the extinguishment or forgiveness of debt, amortization of intangibles, above-market lease assets and deferred lease incentives, net of amortization of below-market lease liabilities and our pro rata share of Adjusted EBITDA adjustments related to the Unconsolidated Joint Venture. Management believes that excluding these costs from EBITDAre provides investors with supplemental performance information that is consistent with the performance models and analysis used by management, and provides investors a view of the performance of our portfolio over time. Therefore, EBITDAre and Adjusted EBITDA should not be considered as an alternative to net income, as computed in accordance with GAAP. The Company uses Adjusted EBITDA as one measure of its operating performance when formulating corporate goals and evaluating the effectiveness of the Company's strategies. EBITDAre and Adjusted EBITDA may not be comparable to similarly titled measures of other companies.

Enterprise Value equals the sum of the Implied Equity Market Capitalization and Net Debt, in each case, as of an applicable date.

Fixed Charge Coverage Ratio is (a) Adjusted EBITDA divided by (b) the sum of (i) Interest Expense, excluding non-cash amortization and (ii) secured debt principal amortization on Adjusted Principal Outstanding. Management believes that Fixed Charge Coverage Ratio is a useful supplemental measure of our ability to satisfy fixed financing obligations.

Fixed Dollar or Percent Increase refers to a lease that requires contractual rent increases during the term of the lease agreement. A Fixed Dollar or Percent Increase lease may include a period of free rent at the beginning or end of the lease.

Flat refers to a lease that requires equal rent payments, with no contractual increases, throughout the term of the lease agreement. A Flat lease may include a period of free rent at the beginning or end of the lease.

Orion Office REIT Inc. | WWW.ONLREIT.COM | 29

| | | | | | | | |

| | |

Q3 2023 SUPPLEMENTAL INFORMATION |

| | |

|

Definitions (cont.) (unaudited, in thousands, except share and per share data) |

|

Funds Available for Distribution ("FAD")

Funds available for distribution, as defined by the Company, represents Core FFO, as defined below, modified to exclude capital expenditures and leasing costs, as well as certain non-cash items such as amortization of above market leases, net of amortization of below market lease liabilities, straight-line rental revenue, amortization of the Unconsolidated Joint Venture basis difference and our pro rata share of FAD adjustments related to the Unconsolidated Joint Venture. Management believes that adjusting these items from Core FFO provides investors with supplemental performance information that is consistent with the performance models and analysis used by management and provides useful information regarding the Company's ability to fund its dividend.

However, not all REITs calculate FAD and those that do may not calculate FAD the same way, so comparisons with other REITs may not be meaningful. FAD should not be considered as an alternative to net income (loss) or cash flow provided by (used in) operating activities as determined under GAAP.

Nareit Funds from Operations ("Nareit FFO" or "FFO") and Core Funds from Operations ("Core FFO")

Due to certain unique operating characteristics of real estate companies, as discussed below, Nareit has promulgated a supplemental performance measure known as FFO, which we believe to be an appropriate supplemental performance measure to reflect the operating performance of a REIT. FFO is not equivalent to our net income or loss as determined under GAAP.

Nareit defines FFO as net income or loss computed in accordance with GAAP adjusted for gains or losses from disposition of real estate assets, depreciation and amortization of real estate assets, impairment write-downs on real estate, and our pro rata share of FFO adjustments related to the Unconsolidated Joint Venture. We calculate FFO in accordance with Nareit's definition described above.

In addition to FFO, we use Core FFO as a non-GAAP supplemental financial performance measure to evaluate the operating performance of the Company. Core FFO, as defined by the Company, excludes from FFO items that we believe do not reflect the ongoing operating performance of our business such as transaction related expenses, spin related expenses, amortization of deferred lease incentives, amortization of deferred financing costs, equity-based compensation, amortization of premiums and discounts on debt, net and gains or losses on extinguishment of swaps and/or debt, and our pro rata share of Core FFO adjustments related to the Unconsolidated Joint Venture.

We believe that FFO and Core FFO allow for a comparison of the performance of our operations with other publicly-traded REITs, as FFO and Core FFO, or an equivalent measure, are routinely reported by publicly-traded REITs, each adjust for items that we believe do not reflect the ongoing operating performance of our business and we believe are often used by analysts and investors for comparison purposes.